Industries We Serve

Construction and Engineering

Construction and engineering companies offer a diverse range of services. These include commercial builders, industrial plant construction, and businesses managing civil engineering projects. The demand for these services are typically related to the demographics and health of the economy.

Supply chain and labor shortages have been among the most pressing recent challenges faced in this sector. Financial success depends on a company’s ability to bid accurately, secure more contracts, and control operational costs.

Education

We serve institutions ranging from elementary schools to colleges and universities, including professional and vocational training centers.

Education faces distinctive funding challenges, heightening the need to manage costs. For public schools, poor performances on measurables like test scores may lead to loss of funding. Colleges and universities must meet requirements of the Higher Education Act or face a loss of eligibility for college loan programs. We help find additional budget to invest back into education.

Energy

When global economies face recession and there are significant fluctuations in energy demand, cost control should become a core strategy to survival and growth. Many companies are cutting planned projects and budgets, but this is typically the wrong cost reduction approach. The industry needs to consider CAPEX, OPEX, and even DECOMEX for cost savings options.

Companies must constantly adapt to high and low economic cycles along with environmental challenges while producing more at lower costs. We can provide full supply chain analysis to uncover savings in time and cost and our ability to source local products for better service, lower transport costs, and on-time delivery.

Financial Services

This industry includes banks, insurance companies, and investment firms. During a time of recession, companies in this sector typically experience losses due to delinquencies, falling asset values, and cutbacks in investments. Though returns may decline during economic slowdowns, lower market values also present opportunities for expansion and investment. Cost transformation initiatives are key to banking reinvestment opportunities.

In the current environment, banks typically need to reduce their cost-income ratio by 10 percentage points or more.

Healthcare and Social Services

This area encompasses hospital medical care, outpatient care provided by physician groups, urgent care, elderly and hospice care, dental work, and social assistance. The Affordable Care Act (ACA) has significantly changed how medical care is acquired, delivered, and paid. New regulations require hospitals to decrease their hospital readmission rates to cut Medicare costs.

Whether managing billing and revenue challenges or implementation of electronic health records (EHRs), operational management should be the priority for healthcare organizations.

Hospitality & Food

Hotels, airlines, and restaurant financial performance are key economic indicators reflecting consumer disposable income and employment levels. When consumer confidence increases, travel frequency swells for both business and leisure travelers. And the primary opportunities for cost reduction are behind the scenes so more creativity is often needed. Competition is higher than it ever has been and the pressure to enhance quality is constant. Reducing costs does not mean sacrificing quality or service.

It takes time to negotiate with suppliers and managing inventory and minimizing waste should be top priorities. In this industry, reducing unnecessary expenses is a continuous process.

Manufacturing

The manufacturing industry is constantly evolving and is continually looking to improve production processes to be more competitive. Production rates can change rapidly depending on economic conditions and manufacturers are being challenged by supplier delivery, raw material costs and availability, and logistics issues (further exacerbated by Covid).

There are so many variables that impact a manufacturer’s performance and the business has become increasingly more complex. Any competitive edge, whether establishing additional buyer channels, negotiating lower prices on raw materials, or better leveraging technology, can significantly improve the financial outlook in any given year.

Nonprofits and Public Sector

A nonprofit organization relies on charitable contributions to support their mission. This includes foundations, advocacy groups, civic clubs, and social organizations. Charitable contributions decrease in tough economic times and these groups are vulnerable to shifts in the economy, with for nonprofits with substantial endowment funds. Managing expenses is often the primary concern for nonprofits.

Budgets are always tight in state and local governments and we find ways to uncover monies to fund additional initiatives and build better communities.

Private Equity

We allow portfolio companies to stay focused on their strategic priorities as we have the resources and expertise to enhance operations, accelerate financial improvement, and deliver improved valuations. Private equity funds have historically leaned on a combination of cost cutting and expansion to support future value projections. But the current macroeconomic and competitive conditions will contest that approach as most markets are facing slowing economies with the threat of recession. At the same time, the most obvious cost reduction opportunities have already been considered in inflated asset prices.

Our research has shown higher performing companies strongly agree with the use of outside consultants to advise on cost reduction opportunities.

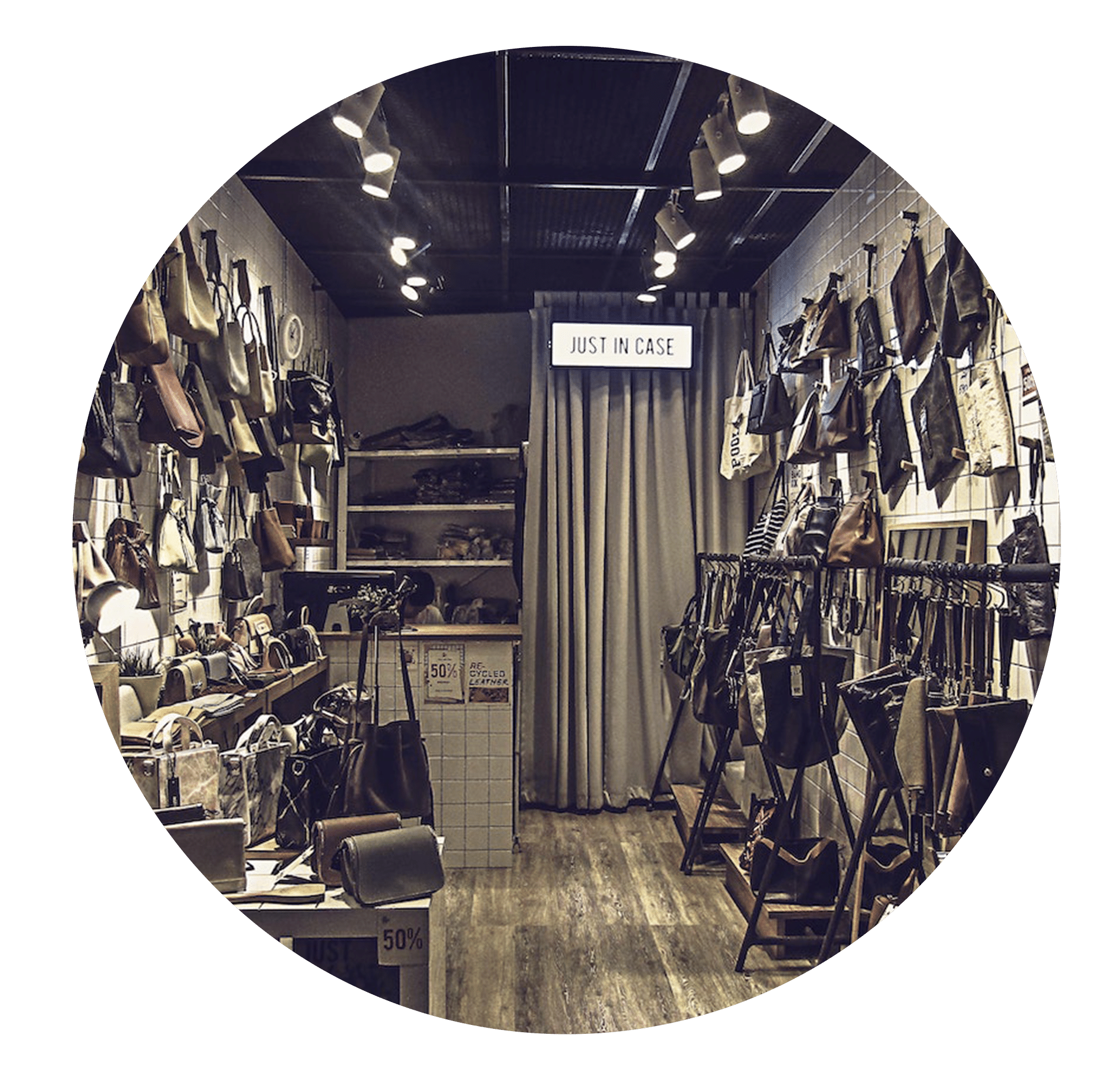

Retail

Competition in the retail trade industry is fierce for both large and small companies that sell various products to consumers or other businesses – from food and household goods to clothing and office supplies. Retailers may stock specialized merchandise, deliver exceptional customer services, and/or offer competitive pricing as points of differentiation.

Consumer trends can shape merchandising strategy and manage retailer costs. Lowering operational expenses will allow retailers the option to offer better pricing to drive additional demand.